UNLOCKING TRANSPARENCY: ENHANCED GUIDELINES FORP2P LENDING OPERATORS’ REPORTING OBLIGATIONSBASED ON OJK CIRCULAR LETTER NUMBER 1/SEOJK.06/2024

Authors

The Financial Services Authority (Otoritas Jasa Keuangan – “OJK”) Regulation Number 10/POJK.05/2022 regarding Information Technology-Based Co-Funding Services (Layanan Pendanaan Bersama Berbasis Teknologi Informasi – “LPBBTI”), which also known as P2P Lending (“OJK Reg 10/2022”) mandates the P2P Lending companies (“P2P Lending Operators”) to comply with the provisions regarding data and information management [1] as well as the submission of periodic reports and incidental reports to OJK [2]. In light of the foregoing, on 31 January 2024, OJK has enacted the OJK Circular Letter Number 1/SEOJK.06/2024 (“OJK CL 1/2024”) as implementing regulation of OJK Reg 10/2022, which regulates on the Procedures and Mechanisms for the Submission of Funding Transaction Data and Reporting for P2P Lending Operators. This ARMA Update will mainly discuss the essential provisions under OJK CL 1/2024, which shall be taken into account for P2P Lending Operators.

PERSON IN CHARGE AND ACCOUNT REGISTRATION

P2P Lending Operators are required to appoint a member of the Board of Director, along with drafting officers responsible for preparing, verifying, and submitting reports on behalf of the P2P Lending Operators. These designated individuals must possess the necessary user ID and password, which can be obtained by requesting access from the fintech lending data centre via an email specified by the OJK. This process must adhere to the guidelines outlined in Appendix IV of OJK CL 1/2024.

FUNDING TRANSACTION DATA REPORT

P2P Lending Operators must report the funding transaction data (development of transaction data between the lenders and borrowers) to the OJK fintech lending data centre, which at least shall contain:

a. information on users;

b. funding transaction information; and

c. funding quality information.

In terms of this technical aspect of these reports, OJK CL 1/2024 regulates as follows:

a. Mechanism : Real time report

b. Alternative Periods : If the fintech lending data centre has yet to be able to receive real time transaction data, then it must be submitted on a daily basis.

This process must adhere to the guidelines outlined in Appendix I of OJK CL 1/2024.

PERIODICAL REPORT AND INCIDENTAL REPORT

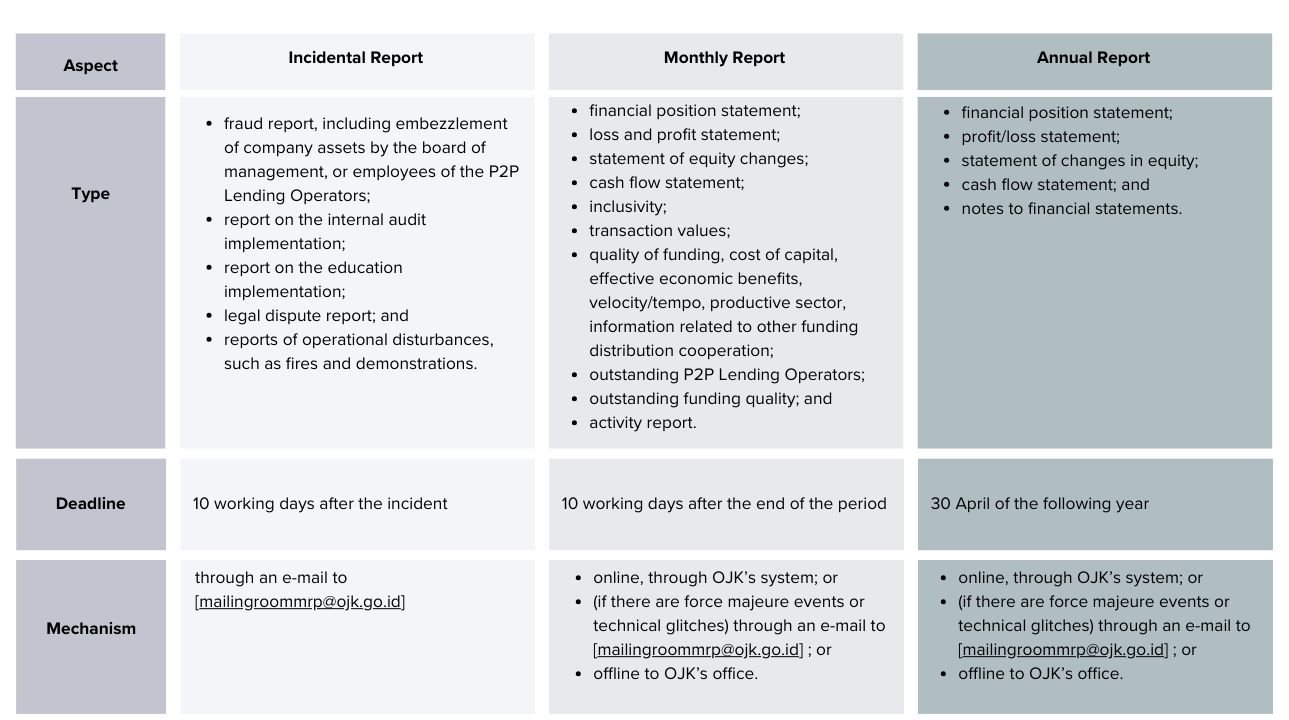

In addition to the Funding Transaction Data Report, OJK CL 1/2024 also requires P2P Lending Operators to submit periodic and incidental reports to the OJK. Periodic reports must be submitted both on a monthly and annual basis and must be audited by public accountants registered with the OJK.

Additionally, it is imperative to note that P2P Lending Operators must ensure the accessibility of their audited financial position reports and income statements, along with any accompanying commentary provided by the public accountants, to the general public. As stipulated in OJK CL 1/2024, these reports must be published through the P2P Lending Operators’ electronic systems, specifically in the front page, no later than 1 (one) month after the end of the period for the submission of annual financial statements.

Further details on how to prepare and submit the abovementioned reports, as well as the format that must be used by the P2P Lending Operators are governed in the Appendix III of OJK CL 1/2024.

COMMENCEMENT PERIOD

It is important to highlight that OJK CL 1/2024 does not specify the commencement period for incidental and annual reports. Nevertheless, we presume that the complete enforcement of reporting obligations for all P2P Lending Operators is expected from 1 July 2024.