Indonesia’s Carbon Capture Storage Regulatory Overview: Presidential Regulation No. 14 of 2024

Authors

On 30 January 2024, Indonesia took a significant step to meet its decarbonization commitment with the enactment of Presidential Regulation No. 14 of 2024 (“PR 14/2024”). This regulation establishes the framework for the implementation of carbon capture and storage (“CCS”) operations within the country.

This Client Update takes a closer look at key provisions of PR 14/2024, exploring what this regulation means for Indonesia’s efforts in minimizing the impact of fossil fuels and accelerating climate change mitigation action.

Regulatory Overview of Carbon Capture and Storage in Indonesia

PR 14/2024 does not mark as the first regulation that regulate CCS activity in Indonesia. Back on 3 March 2023, the Minister of Energy and Mineral Resources (“MEMR”) issued MEMR Regulation No. 2 of 2023 that addresses the organization of CCS and carbon capture, utilization and storage for upstream oil and gas business activities (“MEMR 2/2023”). Furthermore, on 12 January 2024, the Special Task Force for Upstream Oil and Gas Business Activities (Satuan Kerja Khusus Pelaksana Kegiatan Usaha Hulu Minyak dan Gas Bumi – “SKK Migas”) issued the Working Guidelines Number PTK-070/SKKIA0000/2024/S9 (“PTK-070”).

As the umbrella regulation of CCS implementation in Indonesia, PR 14/2024 streamlining the regulatory structure for CCS implementation in Indonesia, extending beyond just the upstream oil and gas working areas, that is governed by MEMR 2/2023 and PTK-070, to also encompass open and mining business license areas.

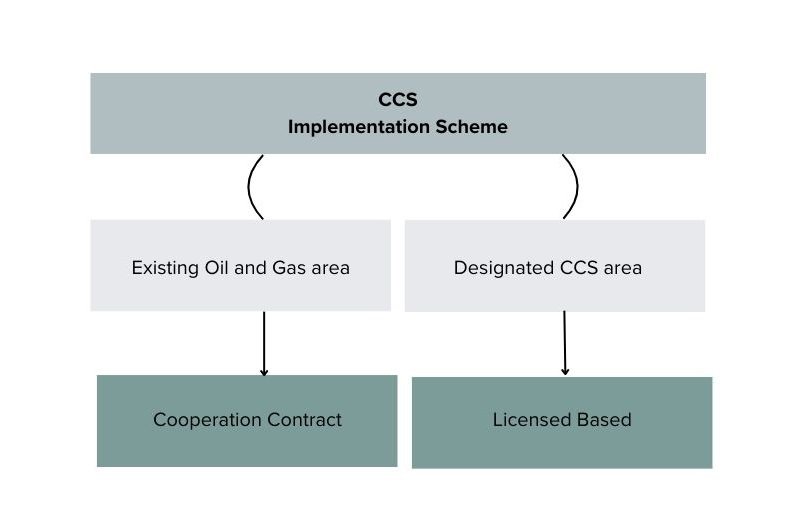

Implementation Scheme of Carbon Capture and Storage

As illustrated above, PR 14/2024 presents 2 (two) different schemes for CCS in Indonesia, namely through the existing oil and gas area or working area (wilayah kerja) and carbon storage operation license area.[1] Each of the area is granted to businesses entities upon fulfilment of requirements stipulated under the Indonesian law.

CCS Implementation in Existing Oil and Gas Area (Working Area)

The implementation of CCS in existing oil and gas area or known as “Working Area” under PR 14/2024 reflects the provisions as stipulated in MEMR 2/2023. Under the PR 14/2024, upstream oil and gas contractors (“PSC Contractors”) are permitted to integrate their exploration and exploitation endeavours with CCS activities within the specified working area delineated in their respective area covered under its production sharing contracts (“PSC”)[2].

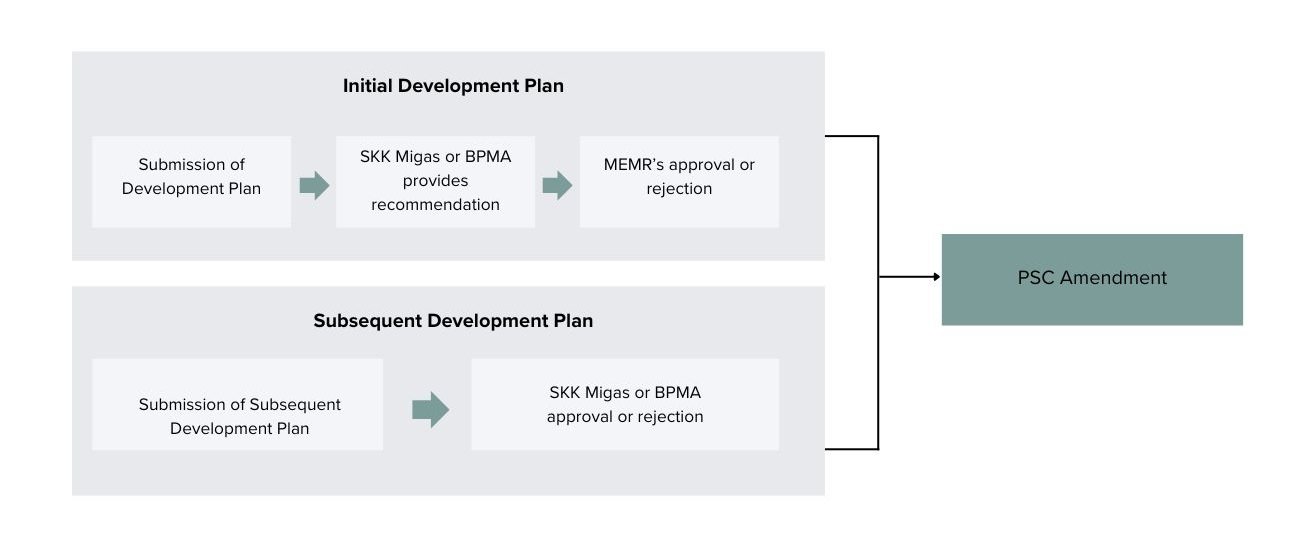

For such integration, the upstream oil and gas contractor is required to submit its CCS implementation plan to SKK Migas or the Aceh Oil and Gas Management Agency (Badan Pengelola Migas Aceh – “BPMA”), based on their respective authority. This submission can be part of the initial or subsequent field development plan, with each condition subject to distinct procedural requirements**[3]** . Following the approval of implementation plan, PSC Contractors are required to amend its PSC to include provisions governing CCS. [4]

CCS Implementation in Designated Carbon Storage License Area

Besides PSC Contractors, third-party entities are permitted to engage in CCS activities by obtaining an exploration and storage operation license within the Carbon Storage License Area (Wilayah Izin Penyimpanan Karbon – “WIPK”). This designated WIPK area encompasses open spaces, mining license areas, and oil and gas work areas [5] . In this regard, the designation of the WIPK is determined by the MEMR based on its determination or proposals submitted by business entities, which comprise of Indonesian entities and foreign permanent establishment (bentuk usaha tetap)[6].

The designated WIPK will be offered to Indonesian entities or foreign permanent establishments through limited selection or auction procedures [7], where the applicable procedures are contingent upon whether the designation is solicited or unsolicited. In the case of an unsolicited designation, PR 14/2024 specifies a limited selection process for offering the WIPK. However, if the designation is solicited (i.e., WIPK is determined by the MEMR), then the offer must follow auction procedures [8].

To carry out CCS in the WIPK, PR 14/2024 recognizes 2 (two) types of licenses, they are exploration and storage operation license. Each of them serves for different purposes and mandates distinct requirements to obtain such licenses.

a. Exploration License

The successful bidder of the limited selection or auction for the WIPK can receive an exploration license valid for 6 (six) years, extendable for an additional 4 (four) years [9], provided that it has fulfilled all administrative, technical, environment, and financial requirements. Upon securing the license, the license holder can commence exploration activities within the Injection Target Zone (Zona Target Injeksi – “ZTI”), including data collection, drilling, subsurface analysis, and mitigation of leakage risks within the ZTI [10].

b. Storage Operation License

Should any potential carbon storage be identified within the ZTI through exploration activities, the holder of the exploration license submits a Plan for Development and Operation to the MEMR. This submission must include technical documents and a wide range of studies outlining the development and operation of the ZTI [11]. If the plan for development and operation of ZTI is approved by MEMR [12], MEMR will issue a storage operation license to the holder of the exploration license. This license will be valid for 30 (thirty) years, with the option for a 20 (twenty) year extension. This license allows the holder to inject and store carbon within the WIPK [13].

Scope of CCS Activities Under PR 14/2024

PR 14/2024 categorizes CCS activities into several stages. The details are as follows:

a. Carbon Capture

PR 14/2024 recognizes several methods of carbon capture, such as carbon separation at oil and gas production facilities, carbon capture from combustion, pre-combustion capture, oxyfuel combustion capture, and through direct air capture technology. Such carbon capture methods can be conducted in the upstream oil and gas facility, oil and gas refinery, power plant, industrial, and other emitting activities, both foreign and domestic.

All carbon capture methods must adhere to technical standards recognized either nationally or internationally by the Indonesian government.b. Carbon Transportation

Transportation of carbon from captured and/or processing facility to the injection site can be carried out through pipes, truck, and/or ship. It is required to secure Carbon Transportation Permit prior conducting the activities. Carbon Transportation Permit can be granted for business entity or the holder of storage operation license, where carbon transportation by pipes can be granted for up to 20 (twenty) years and extended for a maximum of 10 (ten) years for each extension. However, for carbon transportation by truck, ship and/or other methods, it is only granted for up to 10 (ten) years and can be extended for a maximum of 10 (ten) years for each extension.

c. Carbon Injection and Sequestration

The carbon injection and sequestration can be conducted in a depleted reservoir, saline aquifers or coal seams. PR 14/2024 mandates the prioritization of carbon storage capacity for domestic carbon producers. In this regard, PSC Contractors and the holder of storage operation license must allocate 70% of its carbon storage capacity for domestic carbon producer, reserving the remaining 30% for foreign carbon producers who invest or have affiliations with investments in Indonesia.

d. Measurement, Reporting, and Verification (MRV)

Contractor and the holder of storage operation license must conduct MRV in conducting CCS activities. The details are as follows:

i. Measurement Measurement must be conducted once in a year where it must measure carbon inventory and CCS operational parameters. ii. Reporting PSC Contractor or the holder of Storage Operation License must report the mitigation action progress report that cover the activity of carbon capture, transportation, and storage. The documents required for submission include climate change mitigation action plan documents and mitigation action progress reports. iii. Verification The report made by PSC Contractor or the holder of Storage Operation License must be validated and verified by an independent validation and verification institution registered in Indonesia’s national registry system for climate change.e. Closure of Carbon Capture Storage Activities

PR 14/2024 stipulates various conditions that may trigger the closure of CCS operations, this may include, for example the storage reach its full capacity, there is no further carbon injection, expired operation storage license, force majeure, or the operation of CCS is no longer economical.

Business Scheme and Monetisation

Both PSC Contractors and the holder of storage operation license can monetize its activity in the form of storage fee, that is subject to non-tax state revenue (penerimaan negara bukan pajak) [14]. Furthermore, the PR 14/2024 also provides incentives for PSC Contractors and the holder of exploration, carbon transportation, and storage operation license in the form of tax and non-tax treatment [15].

The Implementation of Carbon Economic Value

PR 14/2024 establishes the basis for the implementation of carbon pricing towards the CCS activity. It is mandatory for the Contractor or the holder of Storage Operation License to record and report the implementation of carbon pricing to Indonesia’s national registry system for climate change (Sistem Registri Nasional Pengendalian Perubahan Iklim). The general legal framework for carbon pricing and trading in Indonesia is regulated under Presidential Regulation No. 98 of 2021 on the Implementation of Carbon Economic Value for Achieving Nationally Determined Contribution Targets and Control of Greenhouse Gas Emissions in National Development and Ministry of Environment and Forestry Regulation No. 21 of 2022 on the Guidelines of Carbon Economic Value Implementation.

As of date, Indonesian government has yet to issue any regulations regarding the implementation of carbon pricing for CCS activity.

Divestment and Restriction to Transfer

During the exploration and exploitation phase, PR 14/2024 restricts the transfer of licenses for CCS activities [16]. However, the majority shares of the holder of licenses (in the form of business entity) can be transferred through transfer of shares in the following conditions:

a. Exploration License

The shares can be transferred after the fulfilment of commitment for the exploitation of ZTI and approval by the MEMR.

b. Storage Operation License

The shares can be transferred after obtaining the MEMR’s approval, considering the sustainability of carbon storage operations, in accordance with the provisions of the Carbon Storage Operation License.

Arma Law’s Commentary

PR 14/2024 is a major step forward for the implementation of CCS activities in Indonesia. The regulation highlights the government’s strong desire to become the regional hub for CCS in Southeast Asia.

Several recent actions support this ambition:

-

Execution of Indonesia-Singapore’s Letter of Intent (“LOI”): The execution of LOI between the two countries paves the way for collaboration on CCS projects that cross their borders. This shows Indonesia's proactive approach to regional decarbonization efforts (reducing carbon emissions across the entire region). Following the execution of the LOI, Indonesia and Singapore are working on a bilateral agreement that enable the cross-border transport and storage of carbon dioxide between Singapore and Indonesia.

-

Commencement of Joint CCS Studies: Recent joint studies on CCS conducted by Indonesia further indicate Indonesia’s interest in accelerating the implementation of this technology. In 2023, PT Pertamina (Persero) and Chevron New Energies signed a Joint Study Agreement to examine the feasibility of carbon capture storage and carbon capture utilisation and storage in Kalimantan Timur. Similarly, Japan Petroleum Exploration Co., Ltd., PT Pertamina (Persero), PT Pertamina EP, and Japan Organization for Metals and Energy Security have signed Joint Study Agreement towards carbon dioxide injection field test at the Sukowati oil field in Jawa Timur Province, Indonesia.

Upcoming CCS Regulations in Indonesia

While PR 14/2024 is a great start, there are still some details that need to be further regulated. The government is expected to release additional regulations to clarify these remaining issues. Here are some of the areas where we can expect further guidance on:

- Identification and designation of WIPK. The process for selecting and approving suitable locations for storing captured carbon.

- Carbon specifications. The types and qualities of carbon dioxide that can be stored and transported.

- Project selection procedures. How companies will be chosen to participate in CCS activity through auction or limited selection process.

- Cross-border carbon transportation. The rules for transporting captured carbon across borders, potentially linking with neighbouring ASEAN countries.

- Procedures and requirements for carbon storage certification body. The procedures and requirements for a certification body for carbon storage.

- Transfer of share ownership over business entities. The process and requirements for transferring shares over business entities that conduct CCS activities.

- Procedures and requirements for obtaining exploration, storage operation, and carbon transportation license. The procedure for acquiring licenses, including the relevant requirements or compliance measures needed to obtain these licenses.

- Technical standards for the implementation of CCS. The standard issued or recognized by Indonesian government which shall be used for determining the specification applicable for carbon injection, storage, or transportation.

Article 2 and Article 3 of PR 14/2024. ↩︎

Article 2 (3) of PR 14/2024; Article 11 – 18 MEMR 2/2023. ↩︎

Article 5 of PR 14/2024. ↩︎

Article 4 (3) of PR 14/2024; Article 7 of PR 14/2024. ↩︎

Article 9 (5) of PR 14/2024. ↩︎

Article 10 of PR 14/2024. ↩︎

Article 12 (2) of PR 14/2024. ↩︎

Article 12 of PR 14/2024. ↩︎

Article 17 (1) of PR 14/2024. ↩︎

Article 1 (5) of PR 14/2024 ↩︎

Article 20 of PR 14/2024. ↩︎

Article 23 (3) of PR 14/2024. ↩︎

Article 1 (6) of PR 14/2024. ↩︎

Article 42 of PR 14/2024. ↩︎

Article 43 of PR 14/2024. ↩︎

Article 17 (3) of PR 14/2024; Article 25 (3) of PR 14/2024. ↩︎

Disclaimer:

This client update is the property of ARMA Law and intended for providing general information and should not be treated as legal advice, nor shall it be relied upon by any party for any circumstance. ARMA Law has no intention to provide a specific legal advice with regard to this client update.

Related Updates

Latest Updates