OJK Circular Letter 19/SEOJK.06/2023 on the Organization of LPBBTI (P2P Lending)

Authors

General Overview

The Financial Services Authority (Otoritas Jasa Keuangan – “OJK”) recently issued Circular Letter Number 19/SEOJK.06/2023 regarding The Organization of Peer-to-Peer Lending (“OJK CL 19.06/2023”), an implementing regulation to OJK Regulation 10/2022 regarding Peer-to-Peer Lending (“P2P Lending”).

OJK CL 19.06/2023 outlines new significant provisions related to economic benefits for P2P Lending companies (“P2P Lending Operators”) and addresses various technical aspects of the P2P Lending business.

This ARMA Update will specifically focus on highlighting key points from OJK CL 19.06/2023 that P2P Lending Operators, funding recipients and users in general should take note of.

Maximum Limit of Economic Benefits

Economic benefit is a rate of return which includes:

- interest/margin/profit sharing;

- administration fee/commission fee/platform fee/ujrah which is equivalent to the said fee; and

- other fees, not including late penalties, stamp duty, and taxes.

In this regard, the maximum limits for economic benefits are:

The above-mentioned limit calculations are also applicable for the maximum of late penalties. Economic Benefits and late penalties imposed on funding recipients must not surpass 100% (one hundred percent) of the funding value specified in the funding agreement.

Capacity Analysis

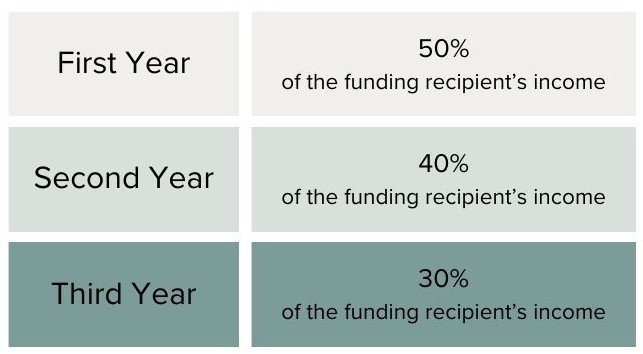

For consumptive funding, prior to giving the green light to a funding applicant, P2P Lending Operators are required to carry out a scoring process. This involves analysing different aspects related to the applicant's ability to repay, such as their character, repayment capacity, capital, economic conditions, and/or any collateral provided. The repayment capability is assessed by comparing the principal repayment amount and the economic benefits received by the funding recipient against their income, subject to the following limits:

A P2P Lending Operator must also ensure that a funding recipient shall not receive fund(s) from more than 3 (three) P2P Lending Operators to ensure that the funding recipient has the repayment capacity for its loans.

Miscellaneous

OJK CL 19.06/2023 also regulates various technical aspects in regard to the P2P Lending business, as follows:

-

Access and Personal Data Management: While conducting business operations, P2P Lending Operators are allowed to access only the camera, location, and microphone on the user's device. It is strictly prohibited for P2P Lending Operators to share users' personal data and information with third parties, unless explicit written consent is obtained from the users, or unless exceptions are specified under the applicable laws and regulations.

-

Information Publishing: P2P Lending Operators are required to display their funding performance prominently on the initial page of their websites, apps, and/or electronic systems. This funding performance information must, at a minimum, include the following details: (i) the amount of disbursed funding; (ii) the number of fund providers; (iii) the number of fund recipients; and (iv) the Repayment Success Rate (Tingkat Keberhasilan Bayar or "TKB”). Additionally, OJK CL 19.06/2023 outlines the specified format for publishing TKBs. All of the foregoing information, except for TKB, should be made publicly available, covering the P2P Lending Operators' business activities as of the starting date, the current year, and presented in a final position format.

-

Collection Activities: When carrying out collection activities, P2P Lending Operators are required to guarantee that their collection personnel have undergone sufficient training related to collection duties. In cases where the collection is handled by external parties through a cooperation arrangement, these external parties must have personnel with certification in collections from a professional certification agency registered with OJK.

-

Emergency Contact: The utilization of emergency contacts is solely for the purpose of confirming the existence of the fund recipient and should not be engaged to gather funds from the owner of the emergency contact. P2P Lending Operators are obligated to confirm and seek approval from the owner of the emergency contact before utilizing such information.

Any funding agreements entered into prior to the implementation of OJK CL 19.06/2023 will remain valid, but they must be modified to align with the provisions of OJK CL 19.06/2023 by its effective date, which is November 8, 2023.

Disclaimer:

This client update is the property of ARMA Law and intended for providing general information and should not be treated as legal advice, nor shall it be relied upon by any party for any circumstance. ARMA Law has no intention to provide a specific legal advice with regard to this client update.

Related Updates

Latest Updates